Toronto, Ontario--(Newsfile Corp. - May 28, 2021) - Cerrado Gold Inc. (TSXV: CERT) ("Cerrado" or the "Company") is pleased to announce its operational and financial results for the first quarter of 2021 ("Q1/21"). These financial results are reported and available on SEDAR as well as on the company website (www.cerradogold.com).

Q1 Operational Highlights

- Gold production reported at 7,485 ounces for Q1 2021, a 45% improvement over Q4/20 production of 5,168 ounces

- Monthly gold production has continuously increased since Cerrado acquired Minera Don Nicolas, highlighted with 3,105 ounces produced in March 2021, an 18% improvement from management expectations

- Total cash costs of $1,363/Au oz sold, a decrease of 18% from the previous quarter

- Mine AISC of $1,747/Au oz sold, a 9% reduction from Q4/20

- Net loss of $5.67 million and basic and diluted loss per share of $0.10

Exploration Highlights

- In Brazil, the 17,000 metre Phase 1 drill program at Monte Do Carmo to expand the overall resource base at the Serra Alta deposit supporting rapid resource expansion

- Initial near mine exploration work demonstrates strong potential to quickly add resources that can be to mine plan at Minera Don Nicolas

- Regional Exploration activities on the over 400,000 ha property in Argentina has commenced with initial targeting of the Michelle and Chispas areas

Corporate Highlights

- Completed our go public transaction to list on the TSXV

- Raised CAD$15 million to fund exploration

- Acquired Minera Mariana in Argentina to add additional resources to support long term growth opportunities

(All dollar amounts are in U.S. dollars ("$") unless otherwise specified)

First quarter 2021 results represent Cerrado Gold's first quarterly results as a public company. Exploration efforts in both Brazil and Argentina continue to progress very positively with regular drill results released over the quarter. Mining operations at Minera Don Nicolas ("MDN") have continued to undergo continuous operational improvements implemented since the acquisition of the mine just a year ago (March 2020). Despite severe ongoing COVID restrictions in Argentina, the Company has seen a significant reduction in the AISC and Cash Costs at MDN driven by improved operational performance at all areas of the mine. Operational results are expected to continue to improve strongly over the course of 2021 as the Company reduces low grade feed to the plant and ore grades further improve, leaving MDN well positioned to generate robust operating results and free cash flow for the foreseeable future.

Mark Brennan, CEO and Co-Chairman, stated: "We are very pleased to report operations at Minera Don Nicolas ahead of management expectations for the first quarter. The team at MDN have been very successful in optimizing the mining feed with greater quantities of higher-grade material to the plant, which itself has been processing well above nameplate capacity, budget and management expectations. This performance has been in spite of severe COVID-19 restrictions which resulted in the loss of 10 operating days in early January and other day to day operating difficulties. The budget has called for a continual advance in the quantity and grade of material fed to the plant as the year progresses following the successful catch up in waste stripping allowing access to higher grade ore. We are comfortable at this stage that our target objectives are well in sight."

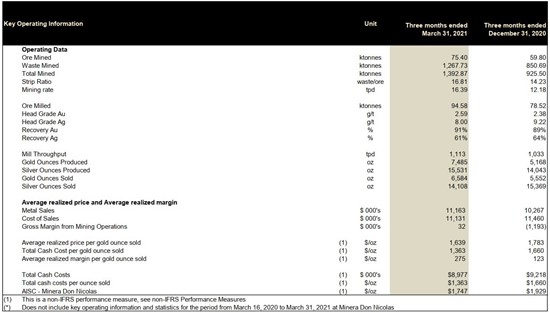

A summary of key operational and financial performance for the first quarter 2021 is provided in the tables below:

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6185/85601_d258fad3246449c0_002full.jpg

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6185/85601_d258fad3246449c0_003full.jpg

First Quarter 2021 Operational Performance

During Q1/21 gold production was 7,485 oz, a 45% increase in Q4/20 gold production of 5,168 oz. This increase is attributable to higher gold and silver grades realized over the year as well as the increase in throughput over the previous quarter.

Mine production for Q1/21 was 94.58 ktonnes, representing a 20% increase over Q4/20 of 78.52 ktonnes, reflecting the use of some low-grade stockpiles to maintain full mill capacity. Daily milled throughput averged 1,113 tpd with many days being sustained over 1,200 tpd.

The average gold head grade of 2.59 g/t represents an increase of 9% over a Q4/20 average gold head grade of 2.38 g/t as the Company continues to mine higher grade ores, with strong improvement expected to be made as the year progresses.

Gold processing recoveries of 91% in Q1/21 were slightly higher than those of Q4/20 due to higher mill throughput and higher gold head grades.

Heading into 2021, the Company anticipates a step up increase in production. First quarter results have exceeded management expectations and the mine remains well positioned to deliver strong performance in 2021.

Monte do Carmo Project, Brazil

Exploration work at the Serra Alta deposit at Monte Do Carmo continued successfully as the company completed the bulk of the planned 17,000 metre drill program to expand the resource base. To date, the bulk of drill results reported fall within the open pit boundary as outlined in the Preliminary Economic Assessment ("PEA") of the current resources defined at the Serra Alta deposit at its Monte Do Carmo gold project in Tocantins State, Brazil. The PEA, titled "Independent Technical Report - Preliminary Economic Assessment for Serra Alta Deposit, Monte do Carmo Project, Tocantins State, Brazil" and dated October 14, 2020 with an effective date of December 5, 2018, was prepared by Porfírio Cabaleiro Rodriguez, B. Terrence Hennessey, Bernardo Horta de Cerqueira Viana and Paulo Roberto Bergmann.

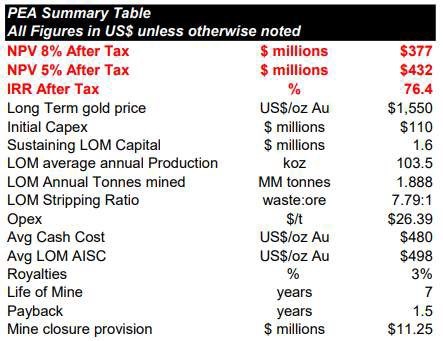

Results of the PEA highlight the significant potential Cerrado anticipates as the overall MDC gold project continues to grow. The Serra Alta deposit is the first of 5 analogue deposits Cerrado is developing and while current resources remain relatively modest in scale, the completion of the PEA underscores the extremely robust economics that should only improve as the resources continue to grow with further drilling.

Highlights and key assumptions of the results include:

- Long Term Gold Price $1,550 per ounce

- 7 Year annual production targeted at approx. 103,000 ounces gold

- Initial Capex $110 million (including US$25 million contingency)

- Total after-tax free cash flow estimated $78 million per annum (Cumulative $548 million)

- Average Cash Costs of $480.95/oz; Avg AISC $498/oz

- Potential to be amongst lowest 10% of AISC cost mines in the world

- Upside potential from continued drilling & resource expansion

A summary of the PEA results is as follows:

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6185/85601_d258fad3246449c0_004full.jpg

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6185/85601_d258fad3246449c0_005full.jpg

The PEA is based on the current Mineral Resource Estimate completed by MICON International Limited, and prepared in accordance with NI 43-101, with an effective date of December 5, 2018 which is outlined in the table below. It should be noted that mineral resources which are not mineral reserves do not have demonstrated economic viability.

The PEA summarized in this document is intended to provide only an initial, high level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of Inferred Mineral Resources. Inferred Mineral Resources are considered to be too speculative to be used in an economic analysis except as allowed for by Canadian Securities Administrators' NI 43-101 in PEA studies. There is no guarantee the project economics described herein will be achieved.

On October 15, 2020, Cerrado announced the commencement of the 2020 drill program at MDC. The program focused on the Serra Alta deposit and consisted of approximately 19,000 metres of drilling utilizing 6 drills aimed at significantly expanding the total ounces in the current Mineral Resource Estimate on the deposit. Cerrado completed the drill program in April 2021, to be followed by an updated Mineral Resource Estimate for late June 2021 and new PEA Report for the end of July.

Cerrado has commenced a second phase drill program in April of 2021 to test the other similar analogous deposit targets along strike such as Capitao, 5 km to the south, Fartura and Ferradura, 2 and 5 kms to the northwest respectively.

First Quarter Financial Performance

In Q1/21, the Company generated revenues of $11.16 million as a result of the sale of 6,584 oz of gold. Average realized price per gold ounce sold was $1,639. Revenues in Q1/21 were up 9% over Q4/20 as a result of higher ounces sold, partially offset by lower average metal prices.

Net loss and basic and diluted loss per share in Q1/21 were $5.67 million and $0.10, respectively, compared to net loss and basic and diluted loss per share of $5.17 million and $0.11 in Q4/20, and $2.78 million and $0.07, respectively in Q1/20. Loss from mining operations in Q1/21 was $0.03 million.

Adjusted EBITDA loss for Q1/21 was $0.96 million, compared to adjusted EBITDA loss of $1.74 million in Q1/20 and adjusted EBITDA loss in Q4/20 of $2.47 million. Cash used in operations in Q1/21 was $1.69 million, compared to $15.34 million in Q1/20, which includes $15.0 million inflows due to the stream arrangement.

Total cash costs per ounce sold for Q1/21 was $1,363, representing a 18% decrease from $1,660 in Q4/20. The All-In Sustaining Cost ("AISC") per ounce sold for the MDN mine was $1,747 in Q1/21, representing a 9% decrease from Q4/20 of $1,929.

Technical Disclosure/Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Robert A. Campbell, M.Sc., P.Geo., Director for Cerrado Gold Inc., whom is a "qualified person" within the meaning of NI 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Mark Brennan

CEO and Co Chairman

Tel.: +1-647-796-0023

mbrennan@cerradogold.com

Nicholas Campbell, CFA

Director, Corporate Development

Tel.: +1-905-630-0148

ncampbell@cerradogold.com

About Cerrado Gold

Cerrado Gold is a public gold producer and exploration company with gold production derived from its 100% owned Minera Don Nicolás mine in Santa Cruz province, Argentina. It also owns 100% of the assets of Minera Mariana in Santa Cruz province, Argentina. The company is also undertaking exploration at its 100% owned Monte Do Carmo project located in Tocantins, Brazil. For more information about Cerrado Gold please visit our website at: www.cerradogold.com.

Disclaimer

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation, All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements.

Forward-looking statements contained in this press release include, without limitation, statements regarding the business and operations of Cerrado Gold. In making the forward-looking statements contained in this press release, Cerrado Gold has made certain assumptions, including, but not limited to ability of Cerrado to expand its drilling program at its Minera Don Nicolas Project and increase its resources. Although Cerrado Gold believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, Cerrado Gold disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/85601

Source: Cerrado Gold Inc.