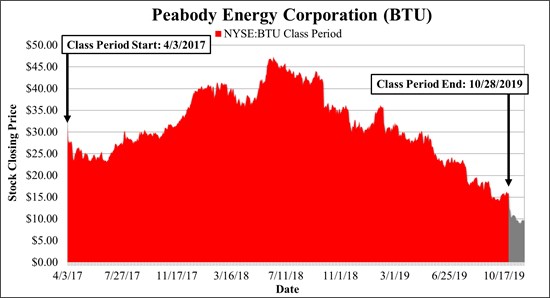

New York, New York--(Newsfile Corp. - November 23, 2020) - If you suffered losses exceeding $100,000 investing in Peabody stock or options between April 3, 2017 and October 28, 2019 and would like to discuss your legal rights, click here: www.faruqilaw.com/BTU or call Faruqi & Faruqi partner James Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310).

There is no cost or obligation to you.

Faruqi & Faruqi, LLP, a leading minority and certified woman-owned national securities law firm, is investigating potential claims against Peabody Energy Corporation ("Peabody" or the "Company") (NYSE: BTU) and reminds investors of the November 27, 2020 deadline to seek the role of lead plaintiff in a federal securities class action that has been filed against the Company.

As detailed below, the lawsuit focuses on whether the Company and its executives violated federal securities laws by failing to disclose the following adverse facts pertaining to the safety practices at the Company's North Goonyella mine, which were known to or recklessly disregarded by Defendants: (1) the Company had failed to implement adequate safety controls at the North Goonyella mine to prevent the risk of a spontaneous combustion event; (2) the Company failed to follow its own safety procedures; and (3) as a result, the North Goonyella mine was at a heightened risk of shutdown.

The truth about the feasibility of Peabody's plan to restart operations at North Goonyella was revealed through a series of disclosures. First, on February 6, 2019, Peabody revealed that, contrary to previous statements, production at the North Goonyella mine would not resume in 2019, but was instead now targeted to begin to ramp in the early months of 2020.

On this news, Peabody shares fell by $3.80 per share, or 10.6%.

Second, on May 1, 2019, Peabody reported that it had received a directive from Queensland Mines Inspectorate ("QMI") which could lead to further delays and necessitate a re-evaluation of the Company's reentry plan.

On this news, Peabody shares fell $1.61 per share, or 5.6%.

Third, on July 31, 2019, Peabody reported additional delays to the reentry of North Goonyella, explaining that QMI's requirements had resulted in a slower rate of progress than Peabody's initial plan had contemplated. As a result, Peabody suspended its 2020 production guidance at the mine and informed investors that it was reevaluating its entire reentry plan.

On this news, Peabody shares fell by $1.06 per share, or 4.8%.

Fourth, on August 9, 2019, QMI released a one-page document with its preliminary investigative findings indicating that Peabody had deficient safety systems at North Goonyella and that the Company was not cooperating fully with its investigation.

On this news, Peabody's stock fell $0.37 per share, or 2 percent.

Finally, on October 29, 2019, Peabody disclosed that QMI was placing strict restrictions on restarting operations at the North Goonyella mine and that as a result Peabody was forced to drastically adjust the reentry plan, ultimately announcing a three year or more delay before any meaningful coal could be produced.

On this news, Peabody shares declined $3.56 per share, or 22 percent.

The court-appointed lead plaintiff is the investor with the largest financial interest in the relief sought by the class who is adequate and typical of class members who directs and oversees the litigation on behalf of the putative class. Any member of the putative class may move the Court to serve as lead plaintiff through counsel of their choice, or may choose to do nothing and remain an absent class member. Your ability to share in any recovery is not affected by the decision to serve as a lead plaintiff or not.

Faruqi & Faruqi, LLP also encourages anyone with information regarding Peabody's conduct to contact the firm, including whistleblowers, former employees, shareholders and others.

Attorney Advertising. The law firm responsible for this advertisement is Faruqi & Faruqi, LLP (www.faruqilaw.com). Prior results do not guarantee or predict a similar outcome with respect to any future matter. We welcome the opportunity to discuss your particular case. All communications will be treated in a confidential manner.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/68821

Source: Faruqi & Faruqi LLP