Hauppauge, New York--(Newsfile Corp. - June 26, 2025) - AJP Holding Company, LLC ("AJP") and Orbic North America, LLC ("Orbic"), an international leader in mobile technology innovation, which together have an investment representing an approximately 19% economic interest in Sonim Technologies, Inc. (NASDAQ: SONM) ("Sonim" or the "Company"), today sent an open letter to the stockholders of Sonim.

In its letter, AJP and Orbic highlight, in the view of AJP and Orbic, the devastating losses suffered by Sonim and its stockholders under the management of the incumbent Board, a series of entrenchment efforts taken by the incumbent board and a seriously flawed strategic evaluation process pursued by the Special Committee of the Board. All stockholders are urged to support AJP's and Orbic's slate of highly qualified and independent nominees at the Company's upcoming Annual Meeting of Shareholders scheduled for July 18, 2025. Only through a immediate and dramatic transformation in leadership will Sonim and its stockholders see meaningful positive change.

The full text of the letter follows:

June 26, 2025

Dear Fellow Stockholders,

Our message is simple:

WE ARE STOCKHOLDERS LIKE YOU: We are your fellow stockholders who beneficially own approximately 1.97 million shares (or 19%) of Sonim Technologies, Inc. ("Sonim") outstanding stock as of June 9, 2025. At the 2025 Annual Meeting of Stockholders, we are nominating a slate of five director candidates to provide Sonim with new leadership comprised of seasoned, industry professionals with the requisite education, skills, experience and appropriate sense of urgency to undertake a strategic assessment of Sonim and evaluate and, if appropriate, implement its strategic alternatives.

WHAT WE BELIEVE:

SONIM'S BOARD & MANAGEMENT HAVE DEMONSTRATED POOR STEWARDSHIP OF THE COMPANY: Sonim's board of directors and management team cannot be entrusted to continue to lead Sonim, having under their management reported a net loss of ($33.65 million) in 2024 or ($7.13) per share and experienced a stock decline of 87% in 2024. This represented the culmination of Sonim reporting several years of losses totaling $(86,452,000) from 2021-2024 and a 98% loss in stock value over the five years ended June 20, 2025.

SONIM'S PRECIPITOUS STOCK PRICE DECLINE HAS DEVASTATED STOCKHOLDER VALUE: Following the announcement of our slate of board nominees, Sonim's board of directors has undertaken a campaign of entrenchment activities and dilutive stock offerings, which has devastated stockholder value and eroded the value of your investment.

SONIM'S BOARD & MANAGEMENT ENTRENCH THEMSELVES: Actions speak louder than words—we believe the entrenchment actions of Sonim's board of directors clearly signal that self-preservation is a top priority for them and that they are keenly focused on financially enriching themselves and management. As part of its campaign of entrenchment, the Sonim board has implemented several anti-takeover devices, including a poison pill and a series of dilutive stock issuances, significantly enhanced severance benefits for its current chief executive officer and chief financial officer and has accelerated the vesting of restricted stock units held by the members of the board and management. These activities have resulted in the transfer of stockholder value from you to the same management group that has led Sonim to delivering devastating financial results.

DON'T BE FOOLED BY THE BOARD & MANAGEMENT'S PROMISES: The Sonim board of directors has not provided you with sufficiently specific details on how the recently proposed non-binding letter of intent for an asset sale to Social Mobile® or non-binding letter of intent for a proposed sale of Sonim's public company shell (the "Reverse Take-Over") will translate into stockholder value. Sonim's announcements fail to provide sufficiently quantifiable metrics, verifiable data and financial analysis demonstrating how the transactions will deliver tangible benefits. Moreover, Sonim's board of directors and management have failed to provide any assurance to stockholders that they will receive any dividend distribution or be offered a stock buyback as a result of either transaction.

WE HAVE OFFERED COMPELLING ALTERNATIVES… AND REAL VALUE: We believe that Sonim has superior prospects to those achieved to date by Sonim's present management team. Orbic North America, LLC has made three compelling acquisition offers (including a revised offer made on June 26, 2025). Orbic's current offer to acquire substantially all of Sonim's assets for a cash purchase price of $25 million, which represents a 66.7% premium of the amount payable by Social Mobile® at an initial closing of that transaction (and a 25% premium if the earnout feature of the proposed Social Mobile® transaction is achieved). The Orbic asset purchase offer also would not impede Sonim from proceeding with the Reverse Take-Over transaction announced in its June 25, 2025 press release.

STOCKHOLDERS DESERVE BETTER: Sonim's board of directors cannot be entrusted to lead Sonim into the future. You deserve better than this. Our slate of nominees will provide Sonim with better leadership to unlock stockholder value.

WE URGE YOU TO VOTE YOUR SHARES ON THE BLUE PROXY CARD FOR THE AJP/ORBIC NOMINEES.

We write to you as committed investors in Sonim at a time when the value of your investment is directly at stake. The outcome of the 2025 Annual Meeting will determine whether stockholders will continue to be subject to an underperforming, entrenched and self-interested board of directors and management team or will have a new group of professional leaders that will breathe life into Sonim. We believe that a transformation in leadership is crucial for Sonim's future success and stockholder value.

Why Immediate and Complete Change is Necessary

- Our nominees for election to Sonim's board of directors (collectively, the "AJP/Orbic Nominees"), bring a wealth of industry expertise, strategic vision and a sense of urgency that is desperately needed at Sonim.

- Only through a transformation in leadership will Sonim and its stockholders see meaningful positive change.

- The AJP/Orbic Nominees are seasoned industry professionals with the requisite education, skills, experience and appropriate sense of urgency to undertake a strategic assessment of Sonim and evaluate and, if appropriate, implement its strategic alternatives.

- Although the AJP/Orbic Nominees have not made any commitment to the AJP/Orbic Parties to do so, the AJP/Orbic Parties believe that the AJP/Orbic Nominees, if elected, are more likely than the current members of the board to advocate in favor of a strategic review process and to substantively engage with Orbic in respect of the acquisition proposal made by Orbic and/or with third parties in respect of one or more other strategic transaction proposals that they may make to Sonim from time to time.

- The proposed asset sale to Social Mobile®, in our view, is highly unlikely to translate into stockholder value and Sonim has failed to provide sufficiently quantifiable metrics, verifiable data or financial analysis demonstrating how the transaction will deliver tangible benefits. Further, on June 25, 2025, Sonim announced that it signed a non-binding letter of intent with an unnamed prospective reverse takeover candidate for its public company shell, without disclosing sufficient details on how the transaction will provide value to stockholders. We have significant doubts that Sonim stockholders will receive any meaningful consideration for a sale of its public company shell. In addition, although it appears that Sonim stockholders will retain a minority equity in the company (specified as to dollar value but not as to percentage ownership) immediately following the Reverse Take-Over transaction, Sonim has failed to assure stockholders that they would receive any cash proceeds from the deal by way of a dividend or stock repurchase.

- At the same time as Sonim is desperately pursuing an asset sale with Social Mobile® and a reverse merger with an unnamed party, over the past several months, Sonim has been regularly diluting stockholders through substantial stock issuances and, with the recent filing of a registration statement for another dilutive offering, it appears that there's no end in sight for these dilutive actions. If Sonim is essentially planning to exit its business through the asset sale, what is the compelling need for issuing additional stock? We can only ask: what can Sonim's board possibly be thinking?

- In view of, in our opinion, Sonim's extraordinarily poor financial and operating performance, its continuing and substantial decline in stock price over the last five years, and its continuing pursuit of sale transactions that we believe will not bring a meaningful cash return to stockholders at their closing, we strongly believe that an immediate and total change in Sonim's leadership and strategic focus is critical not only for Sonim, but also for you—Sonim's stockholders—to maximize return on our investment.

A Demonstrated Track Record of Dismal Management

Staggeringly Abysmal Financial Performance: In 2024, Sonim reported a staggering net loss of $(33,648,000) or $(7.13) per share last year on revenues of $58,298,000. It is difficult for us to imagine how Sonim's management could have executed its business plan so poorly, particularly in the wake of a long string of huge annual losses. Sonim has admitted its dire situation, stating: "We have not been profitable in recent years and may not achieve or maintain profitability in the future."

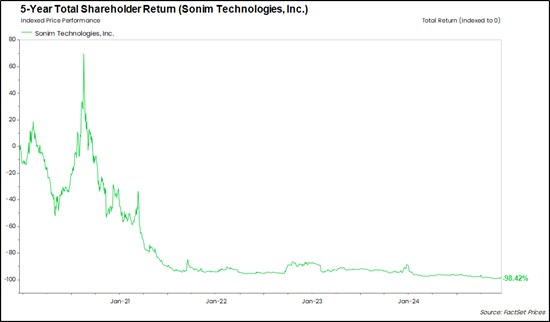

Plummeting Stock Price: Sonim's stock price declined 87% in 2024, capping of a decline of 98% over the five years ending June 18, 2025, sadly as shown in the chart below:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11555/256963_6157a71c5404baf0_001full.jpg

Since last year's Annual Meeting on June 20, 2024, Sonim's stock price has declined from $7.60 to $1.27 on June 20, 2025 … an 83% decline in value in one year!

- Dilution of Stockholder Value: Sonim has diluted stockholders through a pattern of private and at the market stock offerings without stockholder approval, repeatedly at very low prices, and with little to no communication to stockholders. In addition, the offering proposed on Sonim's Form S-1 would be significantly dilutive on top of the substantial dilution caused by the ATM offering and private placement. We view the private and at the market placements as a blatant effort by Sonim to "buy the vote" in complete disregard of proper corporate governance. Moreover, Sonim warns investors that it may continue its dilutive actions, stating "to the extent we need to raise additional capital in the future and we issue shares of common stock or securities convertible or exchangeable for our common stock, our then-existing stockholders may experience dilution . . . ."

Repeated Entrenchment Efforts

Blocked Stock Transfer: Sonim blocked, on what we believe to be spurious grounds, an attempted transfer by AJP to Orbic of a block of 973,173 shares of Sonim common stock, which would have been the starting point for Orbic's efforts to wrest control of Sonim from the incumbent board of directors and to start Sonim back on a path to profitability.

Scorched Earth Poison Pill: Sonim's board of directors has shamelessly adopted a poison pill designed to prevent Orbic from increasing its ownership in Sonim. Orbic would be pleased to further align its interests in Sonim with those of other stockholders and to wrest control of Sonim from the current board and management team.

Unwarranted Financial Rewards: Sonim has entrenched its senior management by:

amending employment agreements to provide enormously enhanced severance benefits to CEO Hao (Peter) Liu and CFO Clay Crolius, neither of which was disclosed broadly to stockholders by the issuance of a press release, and followed the February 2025 award to Messrs. Liu and Crolius of 63,604 and 33,922 restricted stock units, respectively; and

accelerating the vesting of those restricted stock units as well 70,671 restricted stock units held by Chief Commercial Officer Charles Becher, restricted stock units held by other Sonim directors and an undisclosed number of restricted stock units held by 78 other persons.

Strategic Evaluation Process Raises Questions for Stockholders

Lack of Meaningful Engagement: Despite Sonim's public statements to the contrary, neither the Sonim board of directors nor the special committee appointed to evaluate strategic alternatives has engaged in any meaningful dialogue with Orbic regarding its two prior compelling offers. On June 26, 2025 Orbic made a revised offer to acquire substantially all of the assets of Sonim for a cash purchase price of $25 million. Orbic is prepared to move forward expeditiously with the negotiation of an asset purchase of substantially all of Sonim's assets. Orbic's non-binding offer is backed by a $50 million financing commitment from a third-party lender. To date, the board of directors and special committee has chosen to dismiss these offers out of hand, alluding to lack of financial viability and casting aspersions on Orbic, without any dialogue or engagement. We believe our current offer merits serious consideration by Sonim's special committee.

Proposed Social Mobile® Transaction Is Unlikely to Provide Meaningful Returns to Stockholders: Sonim's proposed transaction with Social Mobile®, in our view, would likely yield a disastrous result for stockholders, if it goes beyond the non-binding letter of intent stage and is completed, providing little to no stockholder value. By our estimates, the proposed transaction price on a per share basis, excluding the potential earn-out would be approximately $1.46 per share and would be approximately $1.94 per share if the full earn-out is realized. These estimates assume the full purchase price is allocated to stockholders and does not account for any additional factors such as transaction costs (including legal fees, investment banking fees, and proxy solicitation fees), potential double taxation at the corporation level on the sale of assets and then at the stockholder level with respect to any distributions to stockholders, and the payoff of current Sonim indebtedness, which is estimated to currently be in the range of approximately $3.5 - $4.0 million as of the end of the first quarter of 2025. When the payoff of Sonim's existing debt, transaction costs and taxes are taken into account, Orbic expects that the total amount available for distribution to Sonim stockholders will materially decrease the amount potentially available for distribution and will result in a materially worse outcome for stockholders. As of June 25, 2025, Sonim has failed to enter into a definitive agreement with Social Mobile® and has provided stockholders with little to no specifics as to what they would receive in the transaction and has provided no assurance of paying a dividend or making stock buybacks with transaction proceeds. This lack of clarity creates significant uncertainty regarding the true value stockholders would receive from this transaction. We believe that the special committee's inherent vagueness leaves stockholders exposed to unnecessary risk without a clear path to value realization.

Sale of Public Company Shell Highly Speculative: On June 25, 2025, Sonim announced its entry into a non-binding letter of intent with an undisclosed company, for a proposed business combination involving Sonim's public shell. The Reverse Take-Over would result in the stockholders of the undisclosed company owning a majority in the combined company. Further, the proposed Reverse Take-Over press release does not disclose any specifics of the transaction, failing to provide stockholders with sufficient details on how the transaction will translate into enhanced returns for stockholders. The press release does confirm to stockholders that their ownership of Sonim will be reduced to a minority interest in Sonim if the Reverse Take-Over is completed. In our view, Sonim's lack of specifics raises concerns that the special committee is settling for a suboptimal outcome for its stockholders.

ENOUGH ALREADY!

We're confident that the Sonim stockholder base—exclusive of the entrenched board and management team—have lost confidence in Sonim's board of directors and management team. AJP and Orbic strongly contend that it is time for an immediate and dramatic change. Sonim stockholders deserve strong, capable and open-minded directors, such as the AJP/Orbic nominees, who have the experience and desire to explore every opportunity to unlock stockholder value and return Sonim to profitability.

We need your help to unseat Sonim's incumbent board of directors by electing the AJP/Orbic nominees. A lot rides on your vote and every vote matters! VOTE YOUR SHARES ON THE BLUE PROXY CARD IN FAVOR OF THE AJP/ORBIC NOMINEES.

Respectfully,

Parveen (Mike) Narula,

on behalf of AJP Holding Company, LLC

-and-

Orbic North America, LLC

For more information or assistance with voting your shares, please call AJP/Orbic's proxy solicitor:

Alliance Advisors LLC

150 Clove Rd, #400

Little Falls Township, NJ 07424

Stockholders Call Toll-Free: 833-218-3964

E-mail: orbic@allianceadvisors.com

About Orbic

Orbic, a U.S.-headquartered technology company based in New York, reimagines the connected experience by thinking outside of the mainstream. Using best-in-class technology, Orbic provides meaningful features to customers seeking something unique and accessible to all, without exclusion. As a leader in developing and manufacturing innovative mobile solutions for smart, value-tech consumers, Orbic offers a full portfolio of connected solutions from smartphones and tablets to mobile hotspots and connected laptops. Orbic's extensive global ecosystem of partners, suppliers, and carriers ensures that their products deliver exceptional value and performance, making high-quality technology accessible to a wider audience. For more information, visit www.orbic.us.

Important Information and Where to Find It

The AJP/Orbic Parties have filed with the SEC a definitive proxy statement on Schedule 14A, containing a form of BLUE proxy card, with respect to its solicitation of proxies for the 2025 Annual Meeting of Stockholders.

Stockholders are strongly encouraged to read the Company's definitive proxy statement (including any amendments or supplements thereto) and any other documents filed or to be filed with the SEC carefully and in their entirety when they become available because they contain or will contain important information.

You may obtain a free copy of the AJP/Orbic Parties' proxy statement and any additional soliciting materials that they file with the SEC at the SEC's website at www.sec.gov, or by contacting Alliance Advisors at the address and phone number indicated above.

Participants in Solicitation

AJP Holding Company, LLC, Orbic North America, LLC, Jeffrey Wang, Parveen Narula, Ashima Narula and their director nominees -Douglas Benedict, Joseph Glynn, Gregory Johnson, Suren Singh, and Michael Wallace - under SEC rules, may be deemed to be participants in the solicitation of proxies of Sonim's stockholders in connection with the election of directors at Sonim's 2025 Annual Meeting to Sonim's stockholders.

Stockholders may obtain more detailed information regarding AJP/Orbic's director nominees, under the captions "Questions and Answers Relating to this Proxy Solicitation" and Certain Information Regarding the Participants" of the AJP/Orbic Parties' definitive proxy statement for the 2025 Annual Meeting filed with the SEC on June 24, 2025.

Investor Contact:

Adam Riches

Alliance Advisors

Orbic@allianceadvisors.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/256963

Source: Orbic North America