CASH INJECTION ENHANCES EXPLORATION PLANS FOR 2026

CLOSES 1ST TRANCHE OF, AND EXTENDS $300,000 PRIVATE PLACEMENT TO DECEMBER 30TH

Highlights

Mayo Lake has sold its non-core Trail- Minto Property in the Mayo-Keno area of Tombstone Gold Belt for $1,000,000 to Banyan Gold Inc. Retains a 2% NSR. Banyan can buy-back 1% of the 2% (1/2NSR) for $1,000,000.

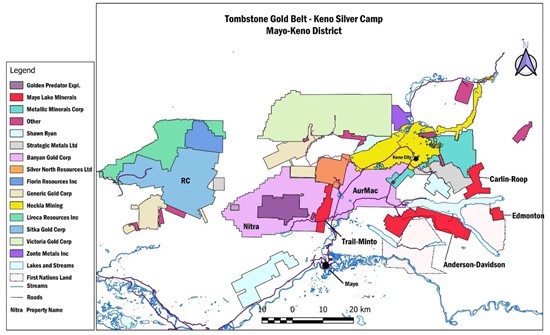

The Mayo-Keno area is the home of many companies with announced and growing resources [1]; Banyan Gold and Sitka Gold lead the hunt for Intrusion Related Gold Systems (IRGS); Victoria Gold has established IRGS resources; Hecla is mining at Keno with an ever-growing-multi-year supply of silver.

This cash will shore up Mayo Lake's financial situation and allow it to focus its 2026 exploration campaign on its three remaining properties in the Mayo-Keno area.

Anderson-Davidson with 4 of 8 prospects being drill ready; drill targets are related to IRGS; over 13,300 metres of anomalous linear gold in soils for guidance in spotting drill holes.

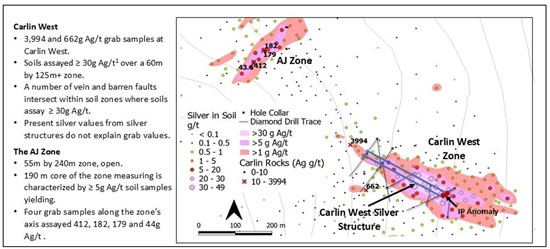

Carlin- Roop silver property at the SE corner of the Keno Silver Camp; the Carlin West zone is defined by a 400m soil anomaly, one 60 by 125m area with all soils assaying ≥ 30g Ag/t and float along the assaying up to 3,994g Ag.

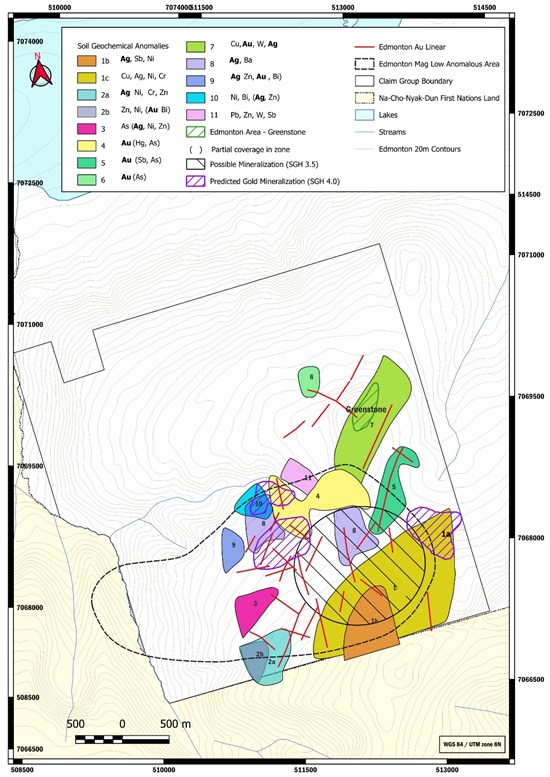

Edmonton is characterized by a broad low marking an alteration zone and intrusive; soil sampling has pointed to numerous gold and base metal anomalies that have been verified by a soil gas survey.

The injection of funds from the sale of Trail Minto gives Mayo Lake the ability to acquire additional value from advanced stage, accretive projects, with or without reported resources.

The company also closed the first tranche of a $300,000 unbrokered private placement (CS and FT shares) and extended the placement's closing date to December 30, 2025.

Ottawa, Ontario--(Newsfile Corp. - December 17, 2025) - Mayo Lake Minerals Inc. (CSE: MLKM) (Company) or (Mayo), is pleased to announce it has entered into a definitive Mineral Property Purchase Agreement (Agreement) with Banyan Gold Ltd, (Banyan) for the sale of its 100% undivided right, title, and interest in and to the Trail-Minto Property, located in the Mayo Mining District of the Yukon (Property) Under the terms of the Agreement, Banyan will acquire the Property from the Company for a total consideration of $1,000,000, payable in cash upon closing, and Banyan will award Mayo a 2% NSR with Banyan having the right to buy back 1/2 of the 2% NSR for $1,000,000 (Mayo retains 1% NSR), subject to necessary regulatory approvals. The transaction will close today, at which time full title to the Property will have been transferred to the Purchaser, free and clear of all liens and encumbrances save and except for the NSR. The Company anticipates using the proceeds from the sale to repay its debt and for general working capital purposes.

Mayo will continue to hold 100% ownership in three highly prospective properties totalling 145.6 sq. km. in area. These properties are all located the Mayo-Keno part of Tombstone Gold Belt / Keno Silver Camp (Figure 1), an area characterized by Intrusion Related Gold Systems, many of which are Reduced Intrusion Related Gold Systems. The Mayo-Keno area has been rejuvenated with (i) Banyan Gold's reporting of Ind. Resources - 2.27M ounces Au (112.5M tonnes at 0.63g /t); and Inf. Resources - 5.45M oz of Au (280.5M tonnes at 0.6 g/t) with enough higher-grade material for a starter pit at its AurMac Project[2]; and (ii) Sitka Gold's reporting of Ind. Resources - 1.29M ounces gold (39.96 tonnes of 1.01g/t) at Blackjack and Eiger; and - 1.04M ounces gold (34.60M tonnes at 0.94g/t) at Blackjack and 0.44M ounces gold (27.36M tonnes at 0.50 g/t) at Eiger[3]. Hecla Mining has reported as of December 31, 2024, Proven Reserves of 0.36M ounces silver (0.013M tons at 24.3 oz./ton), Probable Reserves of 64.0M ounces silver (2.63M tons at 24.3 oz./ton), and Inf. Resources of 19.24M ounces silver (1.30M tons of at 14.8 oz./ton) at its Keno silver mines[4]. Information disclosed from adjacent properties and those from within the Mayo-Keno are not necessarily indicative of the mineralization to be found in the Mayo Lake properties referred to in this disclosure. There has been a noted increase of exploration throughout the Tombstone Gold Belt.

Dr. Vern Rampton, P. Eng. commented that, "Mayo is happy to report that the cash from the sale of Trail-Minto has relieved our financial circumstances to the point where we are now able to proceed with financing for an aggressive exploration program in 2026 on our three highly prospective properties that are located in the Mayo-Keno area. I should point out that we do have one high-grade silver property located in the Keno Silver Camp. These properties have been sitting idle in spite of defined drill targets. At the same time, we can now add to our portfolio seeking out more advanced properties in the northern Yukon and Alaska. We previously had signed an LOI with WestMountain Gold on a property in Alaska having a decent gold resource. It fell through because of our financial circumstances and the difficult times that engulfed the junior market prior to 2025 We may reexamine this opportunity."

Mayo's three prospective properties in the May-Keno Area

Anderson-Davidson (A-D) includes the Anderson Gold Trend (AGT) a 16 by 3 km long belt characterized by gold placer creeks, including Steep, Anderson and Owl as well as a number of unnamed creeks. Eight prospects have been identified in the AGT, of which four are drill-ready through reconnaissance geochemical soil sampling and from the interpretation of high-quality airborne magnetics (Figure 2). The character of most Au in soil anomalies indicate high-grade vein systems The airborne magnetics also point to subsurface intrusions, which are probably the gold source for the vein systems. Results from reverse circulation drill holes (RC) at one prospect indicate the possibility of low-grade sheeted veining. Davidson Creek is the site of one of the larger placer operations in the local area. Soil geochemical and SGH sampling have identified one highly prospective drill-ready prospect in the Davidson Creek drainage basin. The AGT has potential to become a large gold camp based on its large size and number of gold prospects.

Carlin-Roop lies within the Keno Silver Camp. Two high grade silver zones have been defined at its western extremity, Carlin West and AJ (Figure 3). At Carlin West grab samples of rocks along the silver anomaly have assayed up to 3,994 ppm silver. Similarly at AJ, grab samples have assayed up to 412 ppm. At Carlin West, soil samples in a core area, measuring 1,450 sq. metres, all yielded results exceeding > 30g Ag/t (~ 1 oz Ag/t). The Carlin West zone has a footprint and characteristics that match those of the Elsa Mine, which was the second largest producer in the Keno Silver Camp (Cathro, R. J., 2006; Excerpts from Great Mining Camps of Canada). Other potential prospects have been identified for drilling, the most notable being the Roop anomaly near the northern edge of Carlin-Roop. Soil geochemistry and SGH surveys plus magnetic patterns suggest the presence of significant Au±Ag±Cu±Zn mineralization under the Roop anomaly and an intrusion as the source of mineralization near the norther end of Calin-Roop.

Edmonton shows a large magnetic low, 6 sq. km in size (Figure 4). This large magnetic low is interpreted to be an igneous intrusion at depth with an associated alteration zone. In spite of much of the area being covered by glacial pond sediments, results from soils geochemical sampling suggest the presence of gold and base metal mineralization within and flanking the magnetic low. The soil gas program (SGH) confirmed that the mineralization outlined by the geochemical soil sampling is present at intermediate depth.

Private Placement Interim Closing

The Company also announces that it has closed the first tranche of its previously announced private placement consisting of any combination of common share units ('CS Units) and flow-through units ('FT Units') totaling up to $300,000. Both the CS Units and FT Units were priced at $0.05 each.

On closing, the Company issued a total of 2,000,000 CS Units and 1,100,000 FT Units for a total of $100,000 and $55,000 respectively.

Each CS Unit consists of one common share and one-half common share purchase warrant (a "Warrant"). Each whole Warrant is exercisable into one common share at a price of $0.07 for a period of 36 months from the closing date. Each FT Unit consists of one flow-through share (a "FT Share") and one-half common share purchase warrant. Each whole warrant is exercisable into one common share at a price of $0.08 for a period of 36 months from the closing date. Each FT Share will be issued as a "flow-through share" within the meaning of the Income Tax Act.

CS Unit funds will primarily be used to cover working capital and general operating costs whereas FT Unit funds will be used for eligible exploration expenditures qualifying as "CEE" under the Income Tax Act and applicable regulations. The securities issued pursuant to the Offering will be subject to a statutory hold period in Canada of four (4) months and one day after the Closing Date. Purchasers should consult their legal advisors in this regard.

Mayo 's Proposed 2026 Exploration Program. The Company has initiated plans for its 2026 exploration program in the Mayo-Keno part of the Tombstone Gold Belt. Specifically, the funds will be utilized to define in detail more gold targets within the Anderson Gold Trend within the Anderson -Davidson project, to trench the Carlin West and AJ targets within the Carlin-Roop project and to more precisely define gold and base-metal mineralization within the well-defined magnetic low in the south part of the Edmonton property. Drilling will be initiated should funding be available. Readers can access a number of maps and Mayo's history in addition to property news and descriptions at https://www.mayolakeminerals.com/.

Qualified Person. The technical and scientific information contained within this news release has been reviewed and approved by Dr. Vern Rampton, P.Eng., a Qualified Person as defined by National Instrument 43-101 - Standard of Disclosure for Mineral Projects ("NI 43-101").

For additional information, please contact.

Vern Rampton, Ph.D., P.Eng. CEO and Chairman; vrampton@mayolakeminerals.com Tel. 613-836-2594

Darrell Munro, BB. A, LL. B Corporate Administrator dmunro@mayolakemineraals.com Tel 613-836-2594

Lee Bowles, Director: lbowles@ironstonecapital.ca. Tel 011 3462 466 9063 or 416-561 7474

NOT TO BE DISTRIBUTED TO NEWS WIRE SERVICES OR DISSEMINATED

IN THE UNITED STATES

Cautionary Statement Regarding Forward-Looking Information. This news release contains forward‐looking statements and forward‐looking information within the meaning of applicable securities laws. These statements relate to future events or future performance. All statements other than statements of historical fact may be forward‐looking statements or information. The forward‐looking statements and information are based on certain key expectations and assumptions made by management of Mayo. Although management of Mayo believe that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward‐looking statements and information since no assurance can be given that they will prove to be correct. Forward-looking statements and information are provided for the purpose of providing information about the current expectations and plans of management of Mayo relating to the future. Readers are cautioned that reliance on such statements and information may not be appropriate for other purposes, such as making investment decisions. Since forward‐looking statements and information address future events and conditions, by their very nature, they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Accordingly, readers should not place undue reliance on the forward‐looking statements and information contained in this news release.

The forward‐looking statements and information contained in this news release are made as of the date hereof and no undertaking is given to update publicly or revise any forward‐looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. The forward-looking statements or information contained in this news release are expressly qualified by this cautionary statement.

Figure 1. Property Ownership in the Mayo-Keno Area of the Tombstone Gold Belt.

The ownership of Trail-Minto has been transferred to Banyan Gold.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5471/278328_mayolakefig1.jpg

Figure 2. Drill Targets and Prospects on the Anderson-Davidson Property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5471/278328_d6fdc436a49dca12_002full.jpg

Figure 3. High-grade silver drill targets at Carlin West and AJ.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5471/278328_mayolakefig3.jpg

Figure 4. Location of broad airborne magnetic low, associated geochemical soil zones and gold and base metal mineralization as determined by SGH survey. Mag low marks highly altered and mineralized halo overlying an intrusion.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5471/278328_d6fdc436a49dca12_004full.jpg

[1] Further detail on the announced resources and their sources in second paragraph of press release proper.

[2] Technical Report, AurMac Property, Mayo Mining District, Yukon Territory, Canada by Marc Jutras, P.Eng. Ginto Consulting Services Inc.; Tysen Hantelmann, P. Eng., of JDS Energy and Mining Inc. and Deepak Malhotra, Ph.D. of Forte Dynamics; effective August 20, 2025.

[3] Clear Creek Property, RC Gold Project, NI 43-101 Technical Report, Dawson Mining district, Yukon Territory prepared by Ronald G. Simpson, P. Geo., of GeoSim Services Inc., effective date January 21, 2025.

[4] Annual Report, Hecla Mining, December 31, 2024.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278328

Source: Mayo Lake Minerals Inc.