Thunder Bay, Ontario--(Newsfile Corp. - February 17, 2023) - Thunder Gold Corp. (TSXV: TGOL) (FSE: Z25) (OTC Pink: TNMLF) (formerly White Metal Resources Corp) ("Thunder Gold" or the "Company") is pleased to announce diamond drilling has commenced at the Tower Mountain Gold Property, located 50-km west of Thunder Bay, ON.

Chibougamau Diamond Drilling Ltd. ("Chibougamau") was awarded the 4,000-metre contract. A drill was mobilized to site on February 13th and drilling commenced on February 14, 2023. The estimated program duration of the fully funded drill program is seven weeks.

Highlights:

- Exploration data analysis indicates IP chargeability correlates to increased gold grade

- Initial drill holes to target the strongest chargeable anomaly identified to-date

- Additional holes shall target new chargeable targets identified by the 2022 survey

Main objectives for 2023 are:

1) rapidly expand the footprint of the low-grade gold mineralization

2) demonstrate potential for discovery of higher-grade gold mineralization

3) demonstrate potential for additional mineralization elsewhere within the assembled claim package

Wes Hanson P.Geo., CEO of Thunder Gold notes: "Our primary objective with our initial 2023 drill program is to rapidly demonstrate that Tower Mountain offers a conceptual exploration target ranging from 50 to 100 million tonnes averaging 0.70 to 0.90 g/t Au. Our secondary objective is to demonstrate opportunities to increase both the quantity (size) and quality (grade) of the conceptual exploration target. Recent petrographic and geochemistry suggests that mineralization at Tower Mountain may represent a large, magmatic hydrothermal system associated with the alkalic Tower Mountain Intrusive Complex ("TMIC"). Surface sampling has identified anomalous gold mineralization around the entire perimeter of the intrusion, specifically at or near the intrusive-volcanic contact. Gold mineralization is relatively agnostic of rock type and carbonatization is the dominant alteration. We have established a direct relationship between pyrite content, IP chargeability strength and gold grade with each increasing in direct proportion to the other. We believe Tower Mountain offers an opportunity for a large-tonnage, low-grade gold discovery and note that the current 35,000 metres of drilling is woefully inadequate to demonstrate that potential. Our initial drilling targets the strongest chargeable response identified to-date, an anomaly that has been tested by portions of five (5) holes, all of which are clustered at the extreme, southeastern edge of the anomaly. This anomaly persists over 500 metres (length) x 200 metres (width) x +300 metres (depth), offering a potential tonnage of greater than 75 million tonnes. Our analysis suggests that gold grades are approximately 2x higher inside the +40 mV/V anomaly and the frequency of composites greater than cut-off is 2 to 3x more frequent. We also note that the Bench, Ellen and A targets surround the +40mV/V anomaly and may in fact be reflecting the lower-grade peripheral response of the magmatic system that introduced the gold into the host rocks. Our plan is to complete 6-8 holes on 100 metre spaced sections along the length of the priority IP target. An additional 4-6 holes shall test other IP anomalies that we expect will be isolated from the expanded IP survey completed earlier this year."

Compilation Overview

Gold mineralization occurs in both the host volcanic-volcanoclastic rocks as well as in alkalic intrusive dikes and sills likely originating from the alkalic Tower Mountain Intrusive Complex ("TMIC"). Two independent geophysical consultants have completed inversions of the 2021 IP dataset. The results are essentially identical with both interpretations highlighting a large, strong IP chargeable response located adjacent to the Bench target and extending in a northerly direction to the east of the UV deposit, defining a strike length of over 500 metres. (Ref. Figure 1.0). The Company believes that the chargeable anomalies correlate to increased pyrite content which, in turn, correlates to elevated gold grade. This can be observed along the southwestern boundary of the TMIC where drilling has returned anomalous gold grades at the Bench, Ellen, A ("BEA targets") and 110 targets, all of which lie within a 20 mV/V chargeable response. Eighty-five (85) drill holes totalling 16,528 metres currently define the four targets. The BEA targets all lie immediately adjacent to and just outside the 40 mV/V chargeable response. To-date, only parts of five holes penetrate the 40 mV/V response, all of which cut the southeastern corner of the chargeable response. Table 1.0 summarizes the drilled intercepts for these five holes at cut off grades of 0.30 and 0.50 g/t Au.

FIGURE 1 - Phase 1 Drill Plan, IP Chargeability & Bedrock Geology - BEA Target

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/155091_4b5a4edd34d22ba4_001full.jpg.

Table 1 - Summary Results of the Bench Drill Holes

within 40 mV/V Chargeability Anomaly by Cut-off Grade

| Hole ID | Cut-off Grade | From | To | Interval | Average Grade |

| (Au (g/t) | (metres) | (metres) | (metres) | (Au (g/t) | |

| 83818 | 0.3 | 198.30 | 246.00 | 47.70 | 0.58 |

| 0.5 | 229.00 | 246.00 | 17.00 | 0.81 | |

| TM21-106 | 0.3 | 171.50 | 230.00 | 58.50 | 1.01 |

| 0.5 | 186.50 | 200.00 | 13.50 | 1.65 | |

| 0.5 | 213.50 | 230.00 | 16.50 | 1.65 | |

| TM21-120 | 0.3 | 186.50 | 341.00 | 154.50 | 0.81 |

| 0.5 | 186.50 | 239.00 | 52.50 | 1.26 | |

| 0.5 | 222.50 | 239.00 | 16.50 | 2.68 | |

| 0.5 | 251.00 | 258.50 | 7.50 | 0.90 | |

| 0.5 | 267.50 | 299.00 | 31.50 | 0.89 | |

| TM22-134 | 0.3 | 182.00 | 369.50 | 187.50 | 0.55 |

| 0.5 | 195.50 | 233.00 | 37.50 | 0.95 | |

| 0.5 | 258.50 | 270.50 | 12.00 | 1.40 | |

| 0.5 | 339.50 | 369.50 | 30.00 | 0.71 | |

| TM22-135 | 0.3 | 155.00 | 389.00 | 234.00 | 0.76 |

| 0.5 | 155.00 | 174.50 | 19.50 | 1.83 | |

| 0.5 | 197.00 | 209.00 | 12.00 | 0.89 | |

| 0.5 | 239.00 | 245.00 | 6.00 | 1.13 | |

| 0.5 | 264.50 | 281.00 | 16.50 | 0.93 | |

| 0.5 | 326.00 | 389.00 | 63.00 | 0.94 |

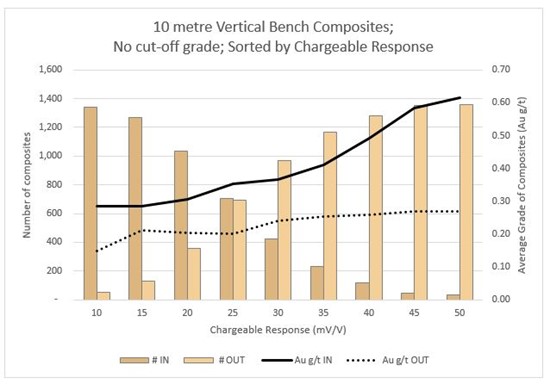

Figure 2.0 (below) summarizes the frequency distribution and average grade of ten metre vertical composite data for the BEA targets at a cut-off grade of 0.00 g/t Au. The populations inside and outside the chargeable response bin are tabulated, At the 10 mV/V; the average grade of the population inside the response is roughly double the small population external to the response. It should be noted that only 54 composites fell outside the response, a statistically insignificant population.

At the 25 mV/V level, the two populations are essentially equal and the average grade of the population inside the response is 75% higher than the population outside the chargeable response bin. This chargeable response level includes the majority of the BEA target composites.

At a 40 MV/V response, the data indicates a population of 116 composites within the chargeable limit which represents less than 10% of the total composite population of the BEA targets. The data suggests that the average grade is approximately 2x higher than the average grade of the much larger population that is external to the 40 mV/V response.

FIGURE 2 - Ten (10.0) metre Composite Data - Frequency Distribution & Average Grade by Chargeability Strength at a Cut-Off grade of 0.00 g/t Au.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5364/155091_figure2tg.jpg.

The data currently suggests grade and frequency of occurrence increases proportionally to the IP chargeable response strength but notes that this assertion is reliant upon a limited data population above the 40mV/V chargeable signal strength targeted by the proposed drill program presented in Figure 1.0 above.

Quality Assurance and Quality Control

Diamond drilling utilizes NQ diameter tooling. The core is received at the on-site logging facility where it is, photographed, logged for geotechnical and geological data and subjected to other physical tests including magnetic susceptibility analysis. Samples are identified, recorded, split by wet diamond saw, and half the core is sent for assay with the remaining half stored on site. A standard sample length of 1.5 meters is employed. Certified standards and blanks are randomly inserted into the sample stream and constitute approximately 5-10% of the sample stream. Samples are shipped to the Activation Laboratories Ltd. facility in Thunder Bay, ON where sample preparation and analyses are completed. All samples are analyzed for gold using a 30-gram lead collection fire assay fusion with an atomic adsorption finish.

About the Tower Mountain Gold Property

The Tower Mountain Gold Property is located 5-km off the Trans-Canada highway, 50-km west of Thunder Bay, Ontario. The property lies within the late Archean Shebandowan greenstone belt, an emerging gold district in northwestern Ontario. The property consists of unpatented and patented lands totalling 1,968 ha. Exploration to-date suggests the property offers a large gold endowment. Gold mineralization is widespread, and diamond drilling has identified low-grade gold mineralization extending outward for at least 500-meters from a central alkalic intrusion known as the Tower Mountain Intrusive Complex. Drilling has established persistent gold grades from 0.1 to 1.0 g/t along a 1,500-meter-long x 500-meter wide x 500-meter deep block of volcanic-volcanoclastic rocks immediately west and adjacent to the central alkalic intrusion. The remaining 6,000 meters of strike length surrounding the intrusion are untested. Tower Mountain shows many of the classic indicators of being an Intrusion Related Gold Deposit, which is a highly desirable exploration target.

About Thunder Gold Corp.

Thunder Gold Corporation, formerly White Metal Resources. is a junior exploration company focused on gold discovery in Canada. For more information about the Company please visit www.thundergoldcorp.com.

On behalf of the Board of Directors,

Wes Hanson, President and CEO

For further information contact:

Wes Hanson, CEO

(647) 202-7686

whanson@thundergoldcorp.com

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to the gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/155091

Source: Thunder Gold Corp.