Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles

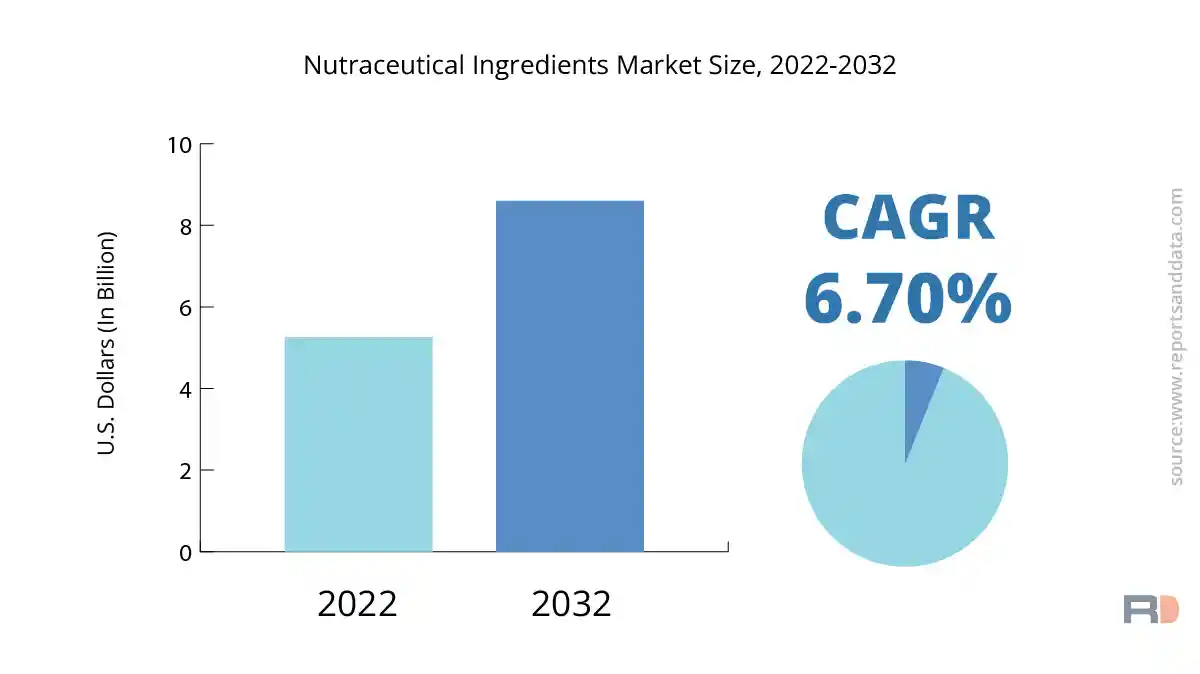

The Nutraceutical Ingredients Market value was USD 5.26 billion in 2022 and is expected to reach USD 8.6 Billion in 2032 growing at a CAGR of 6.7% during the forecast period. Due to their potential health advantages and growing consumer awareness of the value of preventative healthcare, nutraceutical components are becoming increasingly popular with consumers. The need for nutraceutical ingredients is being driven by elements such shifting lifestyles, rising healthcare expenditures, and increased consumer interest in natural and organic goods.

Consumers are taking a more proactive approach to their health due to the rising frequency of chronic diseases like obesity, Diabetes, and cardiovascular conditions. Several food and beverage products incorporate nutraceutical components, which are recognised to have functional qualities that can boost health and well-being. Due to this, the functional food and dietary supplement industries are seeing increased demand for nutraceutical components.

The demand for nutraceutical components is also driven by consumers' increased interest in individualised nutrition and the popularity of "clean label" goods free of artificial additives. Consumers are looking for natural and organic sources of crucial nutrients, vitamins, minerals, and antioxidants to support their overall health and wellness. As a result, novel nutraceutical components derived from plant, marine, and animal sources have been created.

Also, the senior nutrition market is opening up for nutraceutical ingredients due to the ageing population and the growing emphasis on healthy ageing. The older population, looking for ways to maintain their health and well-being in their later years, is becoming more interested in nutraceutical substances known to provide anti-ageing, cognitive health, bone health, and immune health benefits.

The market for nutraceutical ingredients is also experiencing developments in ingredient delivery techniques and technological advancements. Pharmaceuticals, dietary supplements, and food and beverage manufacturers use encapsulation, Microencapsulation, and nanoencapsulation technologies to increase the bioavailability and stability of nutraceutical constituents. This has prompted the creation of innovative formulations of nutraceutical ingredients that provide enhanced health advantages and ease of use.

Furthermore, the demand for eco-friendly and ethically sourced nutraceutical ingredients is being driven by rising consumer awareness of the environmental impact of food production and the necessity for sustainable practices. Customers are looking for ingredients that are produced sustainably, have a small carbon footprint, and are supplied ethically. As a result, manufacturers spend money on R&D to develop novel, environmentally friendly, and consumer-friendly nutraceutical ingredients.

The market for nutraceutical ingredients is confronted with difficulties like strict restrictions, expensive expenses for research and development, and the absence of established definitions and rules for nutraceutical ingredients. Many regions have various regulatory environments for nutraceutical components, and producers may struggle to comply with these regulations. Additionally, the expansion of the industry may be hampered by the high cost of research and development related to the discovery and synthesis of new nutraceutical components.

The market for nutraceutical ingredients is predicted to have a large revenue share for vitamins and minerals. They are frequently used as dietary supplements and are crucial nutrients needed for a number of biological processes. The demand for vitamins and minerals in the nutraceutical ingredients market is driven by the growing awareness of their significance in sustaining overall health and wellness. Additionally, the market for vitamins and minerals is experiencing revenue growth due to the expanding trend of preventive healthcare and the growing customer desire for natural and organic ingredients in food and beverages.

In the market for nutraceutical ingredients, probiotics—beneficial bacteria that support gut health—are a significant subsegment. Due to their potential for helping digestion, boosting the immune system, and supporting mental health, probiotics have drawn a lot of interest. The demand for probiotic-based nutraceutical components is expected to rise in response to the growing interest in gut health and the expanding use of probiotics in functional meals and dietary supplements.

Omega-3 fatty acids, which are necessary fats and are well-known for being anti-inflammatory and having positive effects on heart health, are also expected to help the market for nutraceutical ingredients develop in revenue. Due to their potential health benefits, omega-3 fatty acids are frequently employed in medications, functional foods, and dietary supplements. The market for nutraceutical components is being driven by an increase in consumer knowledge of the value of omega-3 fatty acids in preserving cardiovascular health and cognitive function.

Proteins, both those derived from plants and those derived from animals, make up another sizable portion of the market for nutraceutical components. Proteins are important nutrients needed to develop and repair muscles and tissues. They are also frequently utilised in weight loss, meal replacement, and sports nutrition products. The market for protein-based nutraceutical ingredients is expected to rise in response to the expanding health and fitness trend, increased consumer attention on preserving lean body mass and strength, and rising demand for plant-based protein substitutes.

Fibers, antioxidants, and phytochemicals are a few more sorts of nutraceutical ingredients that are expected to help the industry grow in sales. These substances are well-known for their potential health advantages, which include enhancing immunity, avoiding chronic diseases, and enhancing digestive health. The market for these nutraceutical components is being driven by the growing consumer interest in functional foods and dietary supplements that provide extra health advantages beyond basic nutrition.

The nutraceutical ingredients market is divided into categories based on the provided training data, including functional foods, dietary supplements, personal care, and others. Let's look more closely at each of these application categories.

Functional foods are items that have been enhanced with certain nutraceutical components to provide additional health advantages beyond basic nutrition. These foods are becoming increasingly popular among customers concerned about their general health and well-beingwellbeing and looking for quick and simple solutions. Functional foods frequently contain nutraceutical elements, including vitamins, minerals, probiotics, omega-3 fatty acids, proteins, and others to target certain health issues like digestive, heart, brain, and immunological support. The demand for nutraceutical ingredients in the functional foods market is expected to be driven by rising consumer interest in preventive healthcare and growing consumer awareness of the possible health advantages of functional foods.

Dietary supplements are items that are ingested orally to complement the diet and enhance general health. They can be found in the form of capsules, pills, powders, or liquids and contain nutraceutical substances. These supplements are frequently used to fill in nutritional deficiencies in the diet and offer extra health advantages. Dietary supplements frequently contain nutraceutical elements including vitamins, minerals, probiotics, omega-3 fatty acids, proteins, and others to support various health objectives like immune health, bone health, cognitive health, and energy metabolism. Demand for nutraceutical ingredients in the dietary supplement market is being driven by a rise in consumer awareness of the value of good nutrition, a shift in lifestyle habits, and a growing interest in preventative healthcare.

Personal Care: The personal care sector also makes use of nutraceutical substances to create cosmetic and therapeutic goods for the skin, hair, and general health. In order to give sustenance, protection, and anti-aging effects, nutraceutical elements including vitamins, minerals, antioxidants, and proteins are frequently utilised in personal care products like skincare creams, hair care products, and oral care products. The demand for nutraceutical ingredients in the personal care market is expected to be driven by the growing consumer focus on natural and Organic Personal Care products, rising awareness of the relationship between nutrition and skin/hair health, and rising demand for individualised beauty and wellness solutions.

Others: Nutraceutical compounds are used in sectors like pharmaceuticals, animal nutrition, and food fortification in addition to functional foods, nutritional supplements, and personal care products. Nutraceutical substances are utilised in the pharmaceutical business to create treatments and medications for a variety of illnesses, including cardiovascular disease, bone health, and cognitive issues. Nutraceutical substances are employed in animal feed in the animal nutrition sector to enhance the health and wellbeing of animals, and they are also added to common foods during food fortification to treat nutrient deficiencies and enhance public health. The demand for and revenue growth in the "others" sector of the market for nutraceutical ingredients are expected to be driven by the growing acceptance of these components in a variety of different applications.

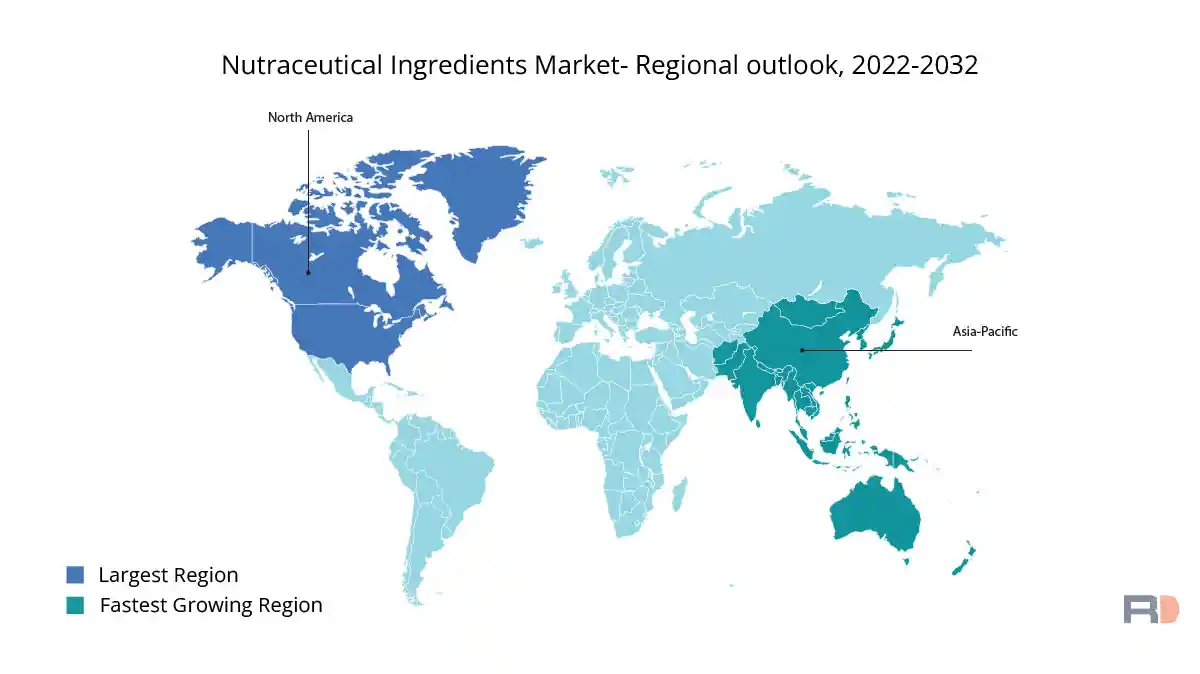

The global market for nutraceutical components is expanding significantly, with different regions playing a role in this growth.

The nutraceutical ingredients market is expected to grow significantly in the Asia Pacific region. The nutraceutical product market is driven by emerging nations like India and China's rapid economic development and increased disposable incomes. Functional foods and dietary supplements are in more demand as a result of these middle classes' growing interest in health and wellness. Also, the proliferation of e-commerce platforms that provide discounts and promotions and the accessibility of inexpensive nutraceutical components are fueling the expansion of the market in the area. China is a key hub for ingredient production and has cheaper component and system prices than many well-known worldwide brands. It is also expected to become a formidable competitor.

The market for nutraceutical ingredients is expected to experience the fastest compound annual growth rate (CAGR) in North America during the projected period. The region's demand for nutraceutical goods is driven by rising awareness of the value of preventive healthcare and a growing trend towards embracing healthy lives. The demand for nutraceutical components has increased as a result of factors including climate change and environmental concerns shifting the focus to natural and organic products. Additionally, the need for cutting-edge and technologically advanced nutraceutical ingredients is being driven by the rising use of smart home technologies and the growing customer preference for high-efficiency and sustainable products.

It is expected that the European market for nutraceutical components will expand moderately. One of the biggest contributors to the national economy is the food and beverage sector, particularly in the UK. The rising demand for functional meals, fortified beverages, and dietary supplements is driving the need for nutraceutical components in the region. To improve the nutritional profile of their products and satisfy the growing customer demand for healthy and functional foods, food and beverage manufacturers, and logistics firms in the UK are increasingly adopting nutraceutical components. To keep the temperature and quality of the components for nutraceuticals at their ideal levels, air conditioning systems are also used in food manufacturing and transportation facilities.

The global nutraceutical ingredients market is characterized by a competitive landscape, with several key players dominating the market. These companies are implementing various strategies, such as mergers and acquisitions, strategic agreements, and product innovation, to gain a competitive edge. Some major companies operating in the global nutraceutical ingredients market include:

| PARAMETERS | DETAILS |

| The market size value in 2022 | USD 5.26 Billion |

| CAGR (2022 - 2032) | 6.7% |

| The Revenue forecast in 2032 |

USD 8.6 Billion |

| Base year for estimation | 2022 |

| Historical data | 2020-2021 |

| Forecast period | 2022-2032 |

| Quantitative units |

|

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Type Outlook, Application Outlook, Regional Outlook |

| By Type Outlook |

|

| By Application Outlook |

|

| Regional scope | North America; Europe; Asia Pacific; Latin America ; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; France; BENELUX; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE; Turkey |

| Key companies profiled | DSM Nutritional Products, BASF SE, Koninklijke DSM N.V, Cargill, Incorporated, Archer Daniels Midland Company, FMC Corporation, Ingredion Incorporated, Kerry Group plc, Ajinomoto Co. Inc, Bioriginal Food & Science Corp., Naturex S.A. (Givaudan), SternVitamin GmbH & Co. KG |

| Customization scope | 10 hrs of free customization and expert consultation |

Facing issues finding the exact research to meet your business needs? Let us help you! One of our Research Executives will help you locate the research study that will answer your concerns. Speak to Analyst Request for Customization

Request a FREE Sample here to understand what more we have to offer over competition…

upto20% OFF

upto20% OFF

Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles