Hole ACD109 Reports 30.48 Metres of 2.43% Copper Equivalent1 (1.87% Copper, 1.00 g/t Gold and 16.69 g/t Silver)

Infill Drill Results Confirm the Broad Higher Grade Domains Within the Mineral Resource Estimate for the Deposit

VANCOUVER, CANADA – Sarah Armstrong-Montoya, President and Chief Executive Officer of Cordoba Minerals Corp. (TSXV:CDB; OTCQB:CDBMF; otherwise “Cordoba” or the “Company”), is pleased to report assay results from the eight additional diamond drill holes completed at the 100%-owned San Matias Copper-Gold-Silver Project.

Highlights:

- Significant assays returned from the eight additional drill holes include (Table 1):

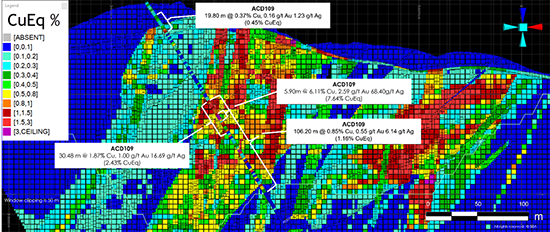

- ACD109 – 106.2 metres (“m”) with 0.85% copper (“Cu”), 0.55 g/t gold (“Au”) and 6.14 g/t silver (“Ag”) or 1.16% copper equivalent1 (“CuEq”), including:

- 30.48 m with 1.87% Cu, 1.00 g/t Au and 16.69 g/t Ag or 2.43% CuEq1,

- 5.90 m with 6.11% Cu, 2.59 g/t Au and 68.40 g/t Ag or 7.64% CuEq1.

- ACD103 – 137.7 m with 0.72% Cu, 0.24 g/t Au and 5.21 g/t Ag or 0.85% CuEq1, including:

- 33.8 m with 1.31% Cu, 0.41 g/t Au and 6.77 g/t Ag or 1.50% CuEq1,

- 25.4 m with 0.92% Cu, 0.31 g/t Au and 6.06 g/t Ag or 1.08% CuEq1.

- Additional late-mineral gold-copper veins, known as Carbonate Base Metal (CBM) veins, have shown correlations in their continuity and grade, and are being investigated further.

- Mineralized intersections confirm the broad higher grade domains within the mineral resource estimate.

“We are incredibly encouraged by these positive results from the infill drill holes which support the higher grade domains in our resource model for the Alacran Deposit. The northern and central areas that we are drilling for the current campaign host multiple high-grade mineralized zones and we look forward to the results of the remaining campaign.” commented Ms. Armstrong-Montoya, President and CEO of Cordoba. “These drilling areas are located in close proximity with numerous local communities. We appreciate their trust and support on our campaign and we are dedicated to maintain the collaborative relationship we shared.”

Additional drill results confirm the broad higher grade domains within the resource model and CBM veins have shown correlations in continuity and grade.

Cordoba commenced a 25,000-metre initial infill drill program in May 2022 and a total of 15,580 metres (71 drill holes) of the initial drill program have been completed to date.

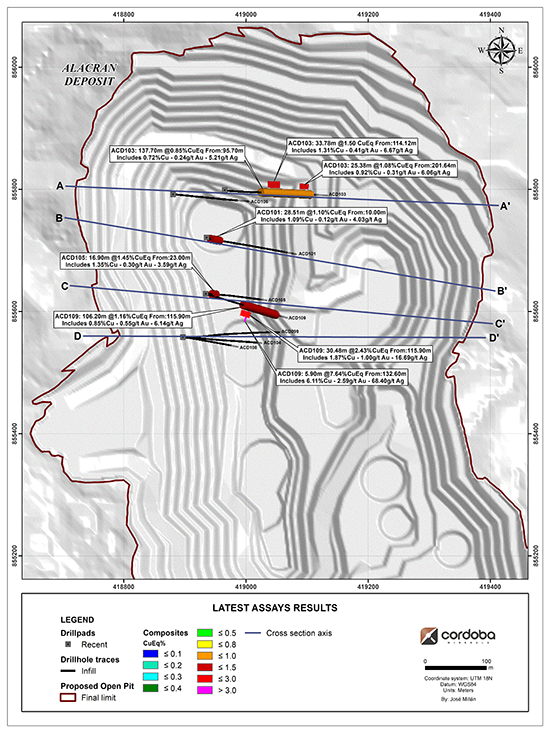

Cordoba has received encouraging assay results for additional eight diamond drill holes (Figure 1). The results continue to confirm the broad higher grade domains within the mineral resource estimate for the Alacran Deposit (Figures 4, 5, 6, 7 and 8).

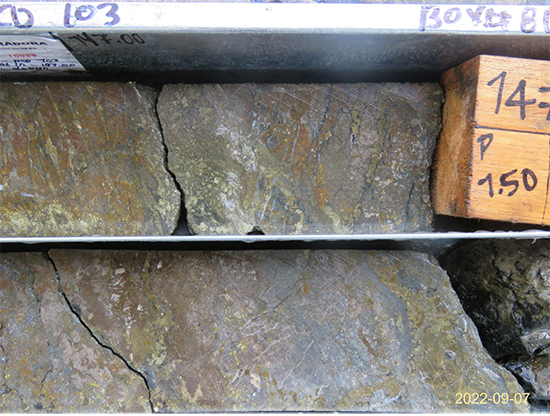

The bulk of the mineralization continues to be within ‘Unit 2’ of the Alacran Deposit – a carbonate rich volcaniclastic unit which is preferentially mineralized by disseminated, semi-massive and massive chalcopyrite, pyrite and pyrrhotite, with occasional mushketovite-magnetite (Figures 10 and 11). Unit 2 also contains beds of fossiliferous limestones, where centimeter-sized elongated fossil bivalves are seen which are preferentially replaced by pyrite and chalcopyrite, resulting in highly enriched grades of copper, gold and silver.

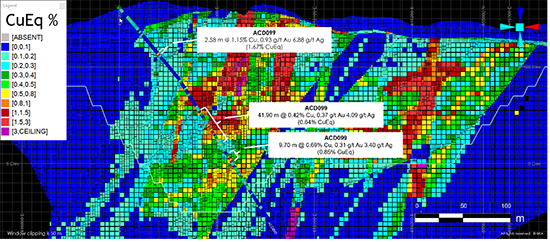

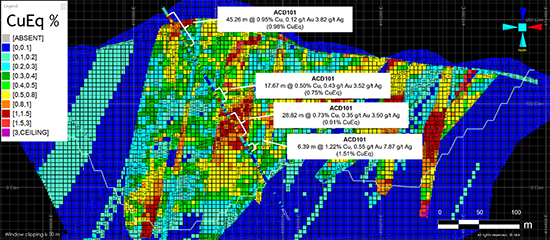

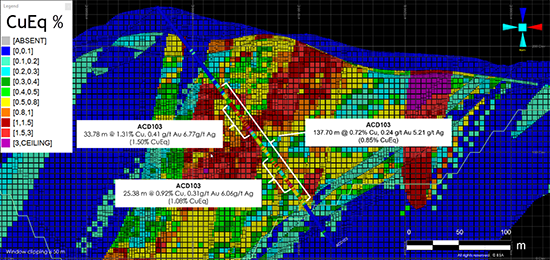

In-fill drill holes ACD101, ACD103 and ACD109 (Figures 2, 3 and 9) have intersected CBM veins that show a close geographical correlation with the vertical high-grade domains in the Pre-Feasibility Study block model. With better correlations in their continuity and grade are being seen, these CBM veins will be modelled further for potential inclusion in the resource model.

Corporate Update

Cordoba has arranged a short-term loan of US$1 million (the "Bridge Loan") from its majority shareholder, Ivanhoe Electric Inc. (“IE”). The Bridge Loan will be evidenced on the existing grid promissory note (refer to Cordoba’s press release dated August 11, 2022) and bears interest at 12% per annum, compounding only at maturity. The interest rate will increase to 14% per annum in the event that Cordoba does not repay the amount owing upon the maturity date, which is December 31, 2022. The purpose of the Bridge Loan is to ensure the Company is able to continue exploration activities on its mineral projects and for general corporate purposes.

| Hole | From (m) |

To (m) |

Interval2 (m) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

CuEq1 (%) |

|---|---|---|---|---|---|---|---|

| ACD099 | 63.40 | 66.25 | 2.85 | 1.15 | 0.93 | 6.88 | 1.67 |

| And | 137.00 | 178.90 | 41.90 | 0.42 | 0.37 | 4.09 | 0.64 |

| Including | 155.60 | 164.00 | 8.40 | 1.04 | 0.74 | 9.06 | 1.47 |

| And | 190.10 | 199.80 | 9.70 | 0.69 | 0.31 | 3.40 | 0.85 |

| Including | 193.10 | 199.80 | 6.70 | 0.91 | 0.36 | 4.41 | 1.08 |

| ACD101 | 10.00 | 55.26 | 45.26 | 0.95 | 0.12 | 3.82 | 0.98 |

| Including | 10.00 | 38.51 | 28.51 | 1.09 | 0.12 | 4.03 | 1.10 |

| And | 116.71 | 134.38 | 17.67 | 0.50 | 0.43 | 3.52 | 0.75 |

| Including | 127.00 | 131.00 | 4.00 | 0.72 | 0.86 | 3.33 | 1.21 |

| And | 151.75 | 180.57 | 28.82 | 0.73 | 0.35 | 3.50 | 0.91 |

| Including | 161.22 | 167.00 | 5.78 | 0.85 | 3.69 | 0.34 | 1.01 |

| And | 194.05 | 200.44 | 6.39 | 1.22 | 0.55 | 7.87 | 1.51 |

| ACD103 | 95.70 | 233.40 | 137.70 | 0.72 | 0.24 | 5.21 | 0.85 |

| Including | 114.12 | 147.90 | 33.78 | 1.31 | 0.41 | 6.77 | 1.50 |

| Including | 201.64 | 227.02 | 25.38 | 0.92 | 0.31 | 6.06 | 1.08 |

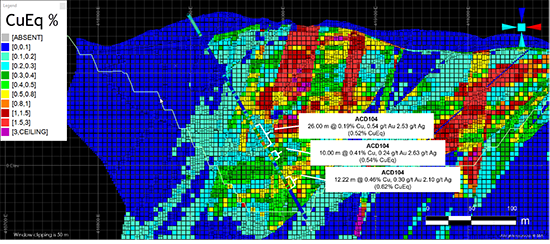

| ACD104 | 140.70 | 166.70 | 26.00 | 0.19 | 0.54 | 2.53 | 0.52 |

| And | 172.70 | 182.70 | 10.00 | 0.41 | 0.24 | 2.63 | 0.54 |

| And | 204.70 | 216.70 | 12.00 | 0.46 | 0.30 | 2.10 | 0.62 |

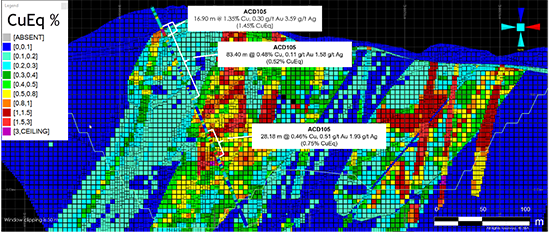

| ACD105 | 23.00 | 106.40 | 83.40 | 0.48 | 0.11 | 1.58 | 0.52 |

| Including | 23.00 | 78.00 | 55.00 | 0.59 | 0.13 | 1.81 | 0.64 |

| Including | 23.00 | 39.90 | 16.90 | 1.35 | 0.30 | 3.59 | 1.45 |

| And | 143.82 | 172.00 | 28.18 | 0.46 | 0.51 | 2.93 | 0.75 |

| Including | 145.20 | 154.50 | 9.30 | 0.66 | 0.75 | 5.19 | 1.10 |

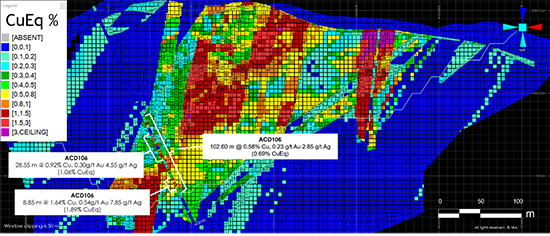

| ACD106 | 145.40 | 248.00 | 102.60 | 0.58 | 0.23 | 2.85 | 0.69 |

| Including | 174.80 | 203.35 | 28.55 | 0.92 | 0.30 | 4.55 | 1.06 |

| And | 194.50 | 203.35 | 8.85 | 1.64 | 0.54 | 7.85 | 1.89 |

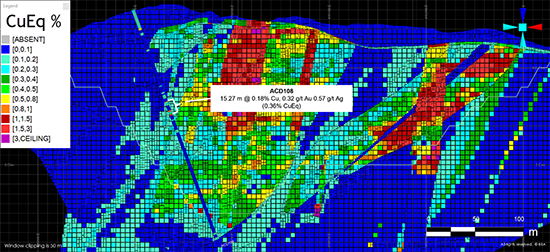

| ACD108 | 100.53 | 115.80 | 15.27 | 0.18 | 0.32 | 0.57 | 0.36 |

| Including | 109.90 | 115.80 | 5.90 | 0.32 | 0.74 | 0.60 | 0.75 |

| ACD109 | 16.00 | 35.80 | 19.80 | 0.37 | 0.16 | 1.23 | 0.45 |

| And | 115.90 | 222.10 | 106.20 | 0.85 | 0.55 | 6.14 | 1.16 |

| Including | 115.90 | 146.38 | 30.48 | 1.87 | 1.00 | 16.69 | 2.43 |

| Including | 132.60 | 138.50 | 5.90 | 6.11 | 2.59 | 68.40 | 7.64 |

Table 1: Drill results for additional eight holes from the 2022 Alacran Deposit infill drill program.

Figure 1: Plan view of the significant intercepts from the additional eight diamond drill holes.

Figure 2: Cross section D – D’ of ACD099

Figure 3: Cross section B – B’ of ACD101

Figure 4: Cross section A – A’ of ACD103

Figure 5: Cross section D – D’ of ACD104

Figure 6: Cross section C – C’ of ACD105

Figure 7: Cross section A – A’ of ACD106

Figure 8: Cross section D – D’ of ACD108

Figure 9: Cross section C – C’ of ACD109

Figure 10: Semi-massive chalcopyrite and pyrite within ‘Unit 2’ carbonaceous mudstones at 147 m below collar in hole ACD103. This sample returned 7.98% Cu, 1.995 g/t Au and 42.6 g/t Ag for 8.85% CuEq1 and is at the base of a 33.78 m higher grade zone between 114.12 m and 147.90 m below collar which returned 1.31% Cu, 0.41 g/t Au and 6.77g/t Ag or 1.50% CuEq1.

Figure 11: An example of high grade CBM vein mineralization with massive chalcopyrite, pyrite, pyrrhotite with minor magnetite at 136 m below collar in ACD109. This sample returned 11.85% Cu, 5.47 g/t Au and 144 g/t Ag for 15.16% CuEq1 within a 30.48 m higher grade zone between 115.90 m and 146.38 m below the collar; assaying 1.87% Cu, 1.00 g/t Au, 16.69 g/t Ag or 2.43% CuEq1.

Technical Information & Qualified Person

The technical information in this release has been reviewed, verified and approved by Mark Gibson, P.Geo., a Qualified Person for the purpose of National Instrument 43-101 – Standards of Disclosure for Mineral Project (“NI 43-101”). Mr. Gibson is the Chief Operating Officer of Cordoba and of Ivanhoe Electric Inc., Cordoba’s majority shareholder, and is not considered independent under NI 43-101. Mr. Gibson verified the data disclosed which includes a review of the sampling, analytical and test data underlying the information and opinions contained therein.

Quality Assurance/Quality Control

Cordoba uses ALS Minerals Laboratory in Medellin, Colombia, ALS Minerals Laboratory in Lima, Peru, and SGS Colombia S.A.S in Medellin, Colombia. These labs operate in accordance with ISO/IEC 17025.

Cordoba employs a comprehensive industry standard Quality Assurance/Quality Control (QA/QC) program. PQ and HQ diamond drill core is cut lengthwise into 3 fractions, 1/4 is sent to geochemistry, half is sent to metallurgy, and 1/4 is left behind in a secure facility for future assay verification.

Some sample shipments are delivered to ALS Minerals Laboratory in Medellin, Colombia where the samples are prepared. Analysis occurs at the ALS Minerals Laboratory in Lima, Peru.

Alternate sample shipments are delivered to SGS Colombia S.A.S in Medellin, Colombia where the samples are prepared and analyzed.

Both analytical labs determine the gold by a 50 g fire assay with an AAS finish. An initial multi-element suite comprising copper, molybdenum, silver, and additional elements are analyzed by four-acid digestion with an ICP-MS finish. All samples with copper values over 10,000 ppm and gold greater than 10 ppm are subjected to an overlimit method for higher grades, which also uses a four-acid digest with an ICP-ES finish, and fire test with gravimetric finish. Certified reference materials, blanks, and duplicates are randomly inserted at the geologist's discretion and QA/QC geologist's approval into the sample stream to control laboratory performance (15%).

The Bridge Loan

The Bridge Loan constitutes a "related party transaction" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions (“MI 61-101”) as IE is a related party of Cordoba given its greater than 10% beneficial shareholding. Pursuant to Section 5.7(1)(f) of MI 61-101, the Company is exempt from obtaining minority approval of the Company's shareholders in respect of the Bridge Loan because it was determined that the Bridge Loan is on reasonable commercial terms that are not less advantageous to the Company than if the Bridge Loan was obtained from a person dealing at arm’s length with the Company and because the Bridge Loan is not convertible into, or repayable in, equity or voting securities of the Company or a subsidiary of the Company or otherwise participating in nature. The Company will file a material change report in respect of the Bridge Loan. However, the material change report will be filed less than 21 days prior to the closing of the Bridge Loan, which is consistent with market practice and which the Company deems is reasonable in the circumstances.

About Cordoba

Cordoba Minerals Corp. is a mineral exploration company focused on the exploration, development and acquisition of copper and gold projects. Cordoba is developing its 100%-owned San Matias Copper-Gold-Silver Project, which includes the Alacran deposit and satellite deposits at Montiel East, Montiel West and Costa Azul, located in the Department of Cordoba, Colombia. Cordoba also holds a 51% interest in the Perseverance Copper Project in Arizona, USA, which it is exploring through a Joint Venture and Earn-In Agreement. For further information, please visit www.cordobaminerals.com.

ON BEHALF OF THE COMPANY

Sarah Armstrong-Montoya, President and Chief Executive Officer

Information Contact

Ran Li +1-604-689-8765

info@cordobamineralscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, that exploration will lead to the discovery of additional mineralization; results of the current exploration; mineralization potential of CBM veins identified; and that ongoing exploration will lead to a potential discovery; the Bridge Loan, including the drawdown, repayment schedule and intended purposes of the Bridge Loan; additional advances by IE; and filing of a material change report on the Bridge Loan. Forward looking-statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which Cordoba operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. There can be no assurance that such statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include actual exploration results, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, uncertainties relating to epidemics, pandemics and other public health crises, including COVID-19 or similar such viruses, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading “Risks and Uncertainties” in the Company’s most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law. Readers are cautioned not to put undue reliance on these forward-looking statements.

1 Copper equivalent (“CuEq”) is calculated using the formula CuEq=((Copper%*Copper recovery)+100*((gold grade*gold recovery)/31.10305)/((copper%*copper price)*2204.62)+100*((silver grade*silver recovery)/31.10305)/((copper%*copper price)*2204.62) using the following assumptions: Metal prices of US$3.25/lb copper, US$1,600.00/oz gold, and US$20.00/oz silver, copper recovery of 92.5% (fresh and transition zone only), gold recovery of 78.1% and silver recovery of 62.9%.

2 Intervals are reported as core length only. True widths are estimated to be between 75% and 100% of the core length.