Sustainable Fund Flows in 2019 Smash Previous Records

This could be the leading edge of a huge wave of assets into sustainable funds.

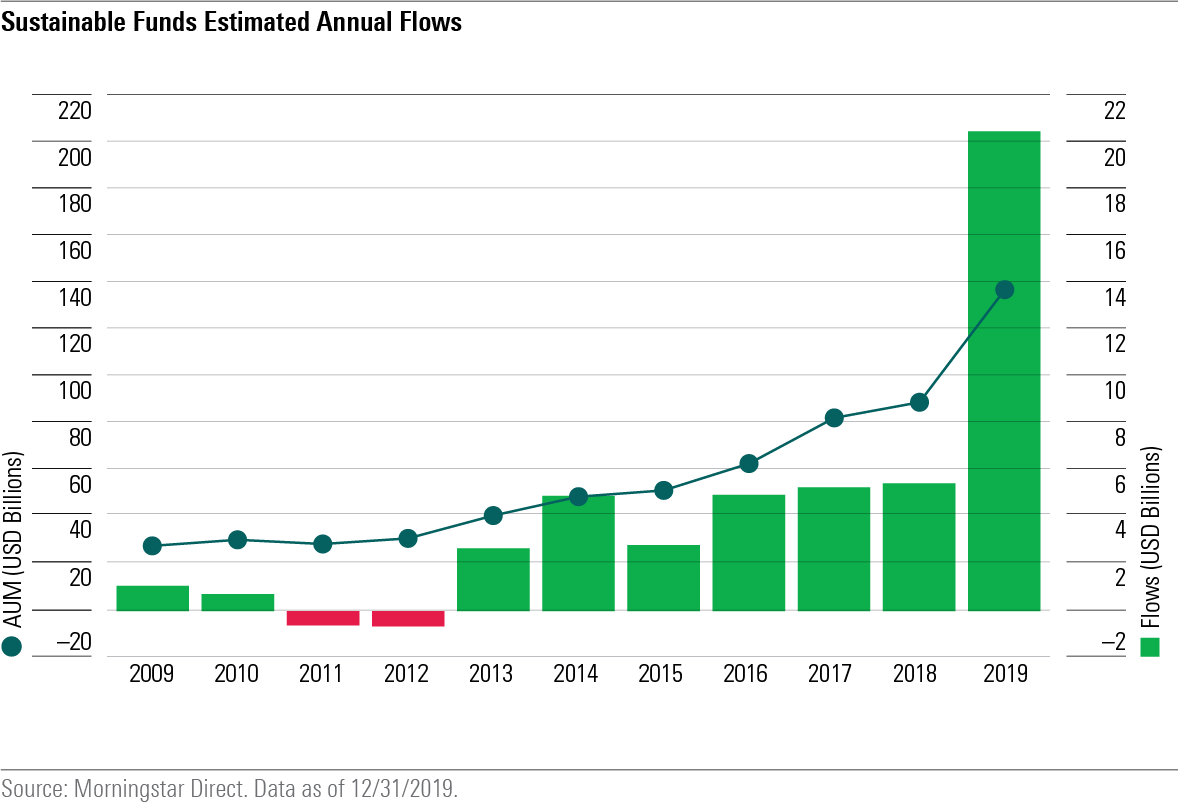

Sustainable funds in the United States attracted new assets at a record pace in 2019. Estimated net flows into open-end and exchange-traded sustainable funds that are available to U.S. investors totaled $20.6 billion for the year. That's nearly 4 times the previous annual record for net flows set in 2018.

The flow data encompasses 300 mutual funds that thoroughly integrate environmental, social, and governance factors into their investment processes, and/or pursue sustainability-related investment themes, and/or seek measurable sustainable impact alongside financial returns.

The sustainable funds group does not contain funds that employ only limited exclusionary screens without a broader emphasis on ESG, nor does it contain the growing number of funds that now acknowledge that they consider ESG factors in a limited way in their security selection.

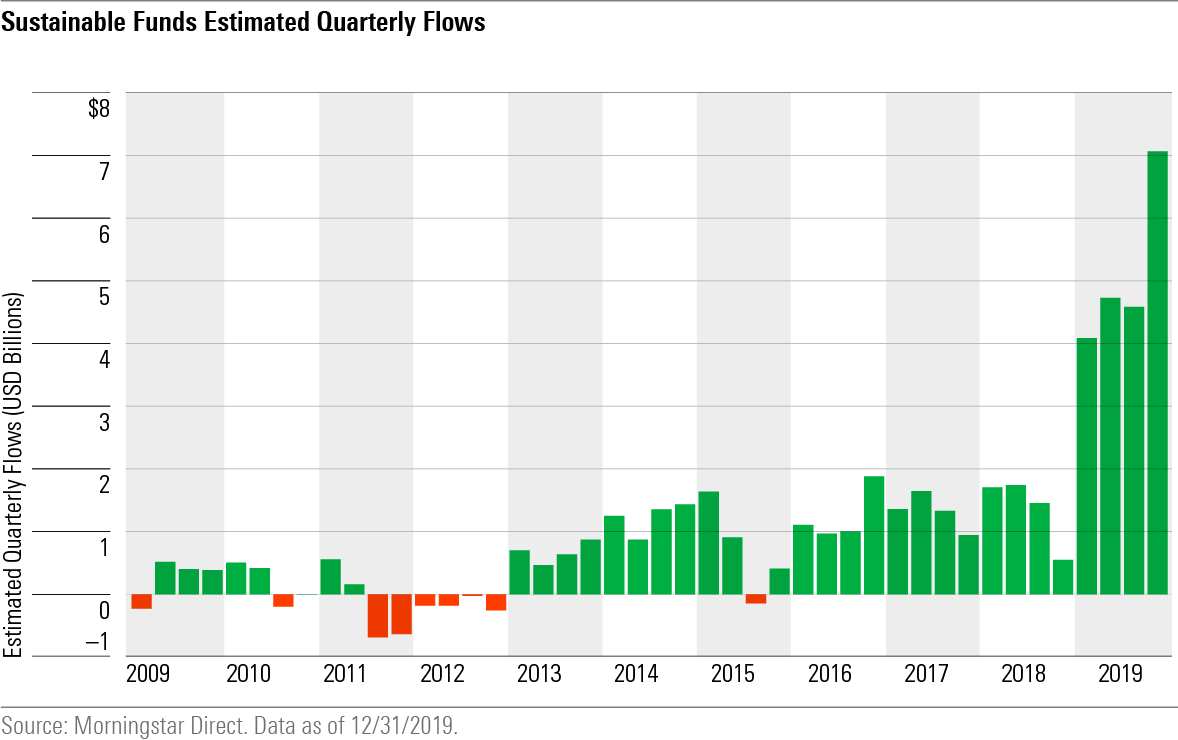

Flows picked up momentum over the course of 2019. During the fourth quarter, estimated net flows jumped to $7.1 billion, easily surpassing the record high for a quarter of $4.8 billion, set in 2019's second quarter.

With growing investor interest in sustainable investing, especially among younger investors, 2019's flows may be the leading edge of a huge wave of assets to come.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)